Condo Insurance in and around Cabot

Condo unitowners of Cabot, State Farm has you covered.

State Farm can help you with condo insurance

Home Is Where Your Condo Is

With plenty of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm straightforward. As one of the top providers of condominium unitowners insurance, you can enjoy incredible service and coverage that is competitively priced. And this is not only for your condo unit but also for your personal belongings inside, including things like books, furniture and clothing.

Condo unitowners of Cabot, State Farm has you covered.

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

When a hailstorm, a windstorm or vandalism cause unexpected damage to your condominium or someone is injured on your property, having the right coverage is important. That's why State Farm offers such great condo unitowners insurance.

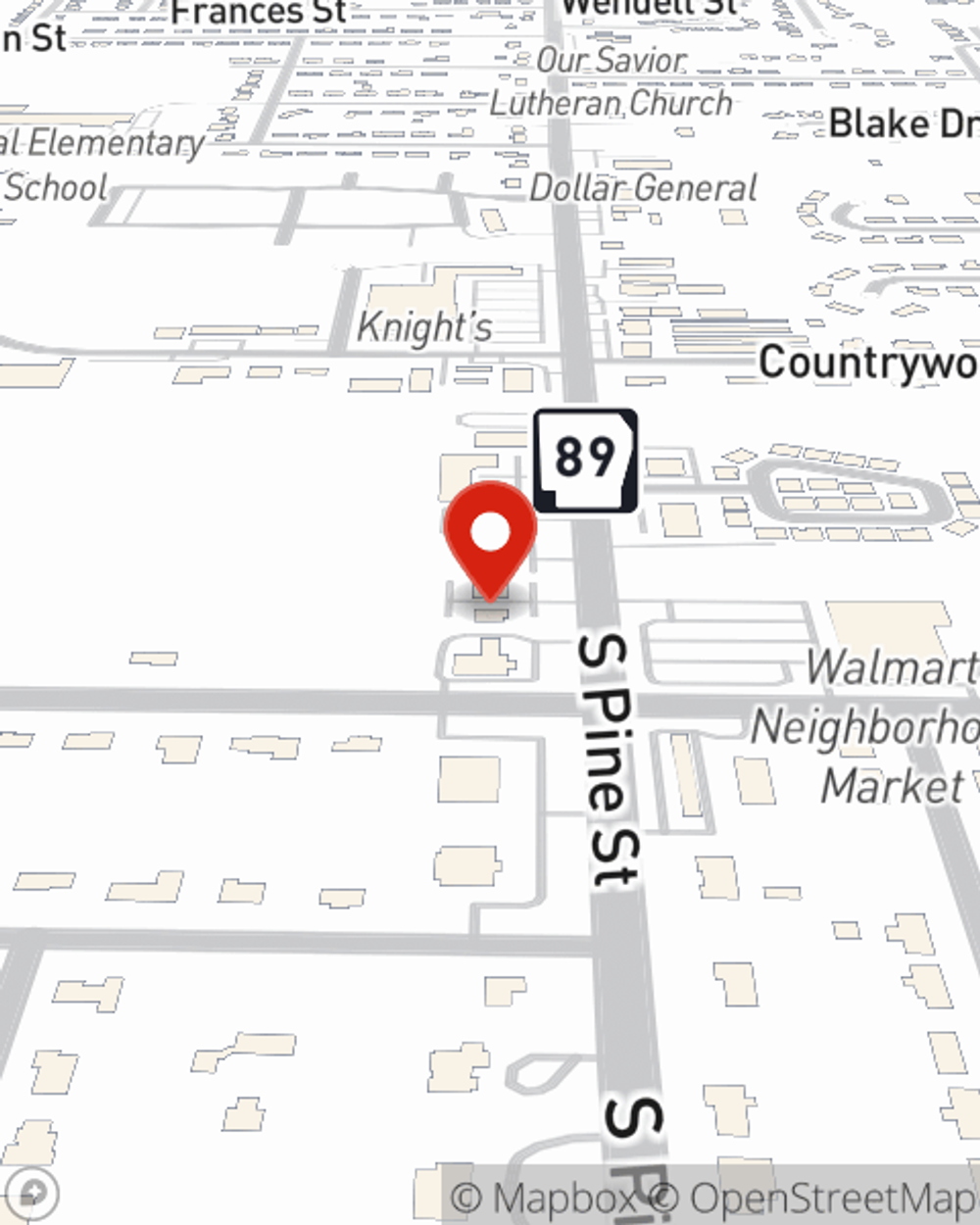

As a value-driven provider of condo unitowners insurance in Cabot, AR, State Farm strives to keep your home protected. Call State Farm agent Brad Hankins today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Brad at (501) 843-1131 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Brad Hankins

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.